Domestic general consumption in the second half of 2024 is expected to improve year-on-year, driven by wage reform policies, the delayed effects of monetary policy, and a strong recovery from manufacturing activities…

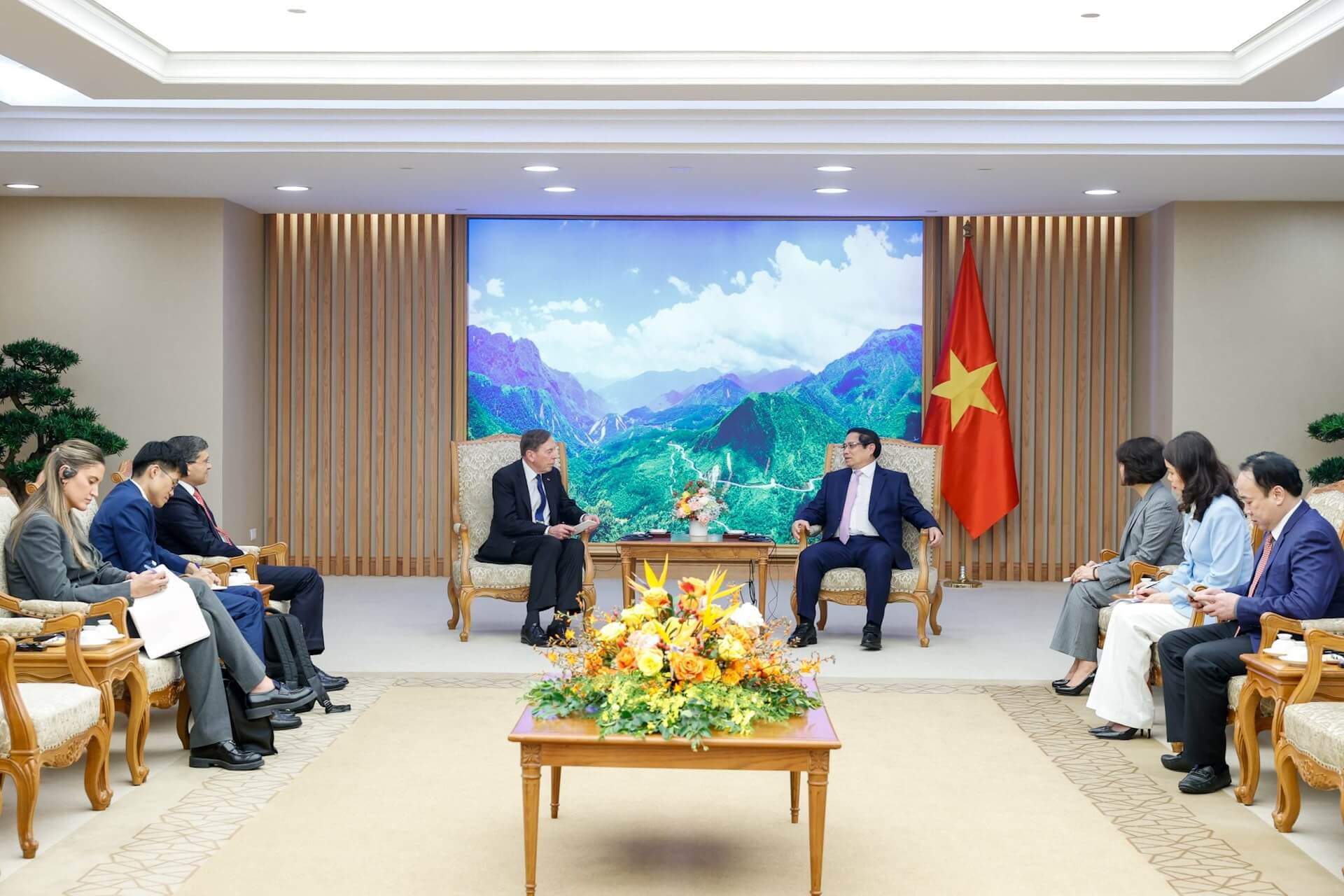

Inside the Winmart supermarket operated by Masan.

In a recently released report analyzing the essential consumer goods industry, Viet Dragon Capital Securities (VDSC) cited information from market research firm Kantar Worldpannel showing that in the first 6 months of 2024, the value across most key segments in the essential consumer goods industry grew negatively due to stagnant consumer sentiment.

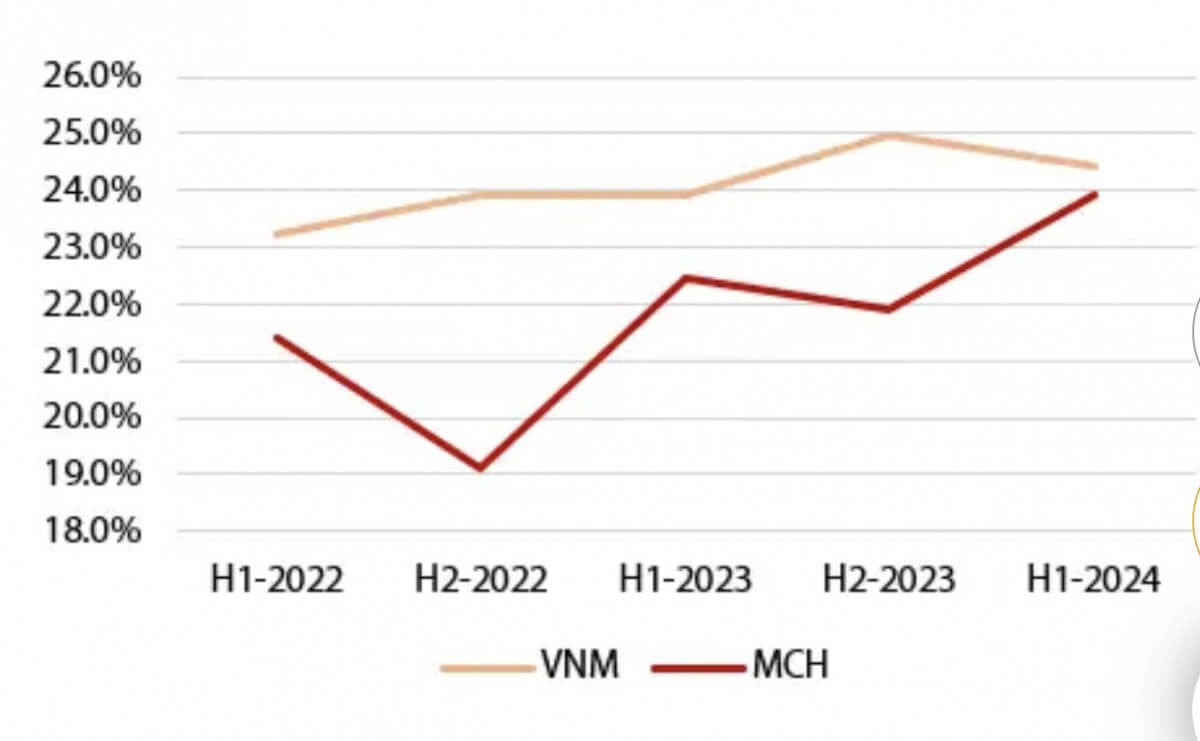

However, large enterprises in this industry still recorded revenue growth against the trend. Specifically, Vinamilk (VNM) increased by 5.7% over the same period last year, Masan Consumer (MCH) – a member of Masan Group, grew by 11.6%.

The revenue growth of the above enterprises can be attributed to the effectiveness of advertising strategies, increased promotions at distributors, and expanded coverage, thereby helped boost market share both domestically and internationally. In addition, the weak general consumption landscape, which is characterized by low prices, has become more popular.

Regarding VNM, the strategy of updating packaging and launching multiple advertising campaigns since late 2023 has proven effective in the first quarter of 2024. VNM has also promoted promotions at retail outlets and distributors recently to enhance competitiveness and contribute to market share growth.

Regarding MCH, the company has successfully attracted more customers, resulting in a higher penetration rate related to the use of Masan products, thanks to the wider coverage of the Winmart system and some active sales policies (more marketing/promotion budgets) that MSN implemented to stimulate orders at each sales point.

This argument is reflected in the selling and administrative expense ratio/revenue ratio of both companies, which have recorded an increase in the past few quarters. However, this also leaves a question mark that needs to be answered about the long-term sustainability of VNM’s market share increase: when the economy rebounds, will consumer trends shift back to higher-end products?

Selling and administrative expenses/revenue ratio (%) of VNM and MCH. Source: VDSC

In a favorable position to maintain growth

VDSC asserts that large enterprises in the essential goods industry are in a favorable position to maintain growth momentum in the second half of 2024.

Specifically, domestic general consumption is expected to improve compared to the same period last year, thanks to wage reform policies; the delayed impact of monetary policy; a strong recovery from production and import-export activities in the first half of the year, helping to increase income and consumer confidence in the second half of the year.

The bae salary has been adjusted from VND 1.8 million/month to VND 2.34 million/month (up 30%) from July 1, 2024. The budget allocated for the 2024 wage reform program is estimated at 1.2% of total retail sales of goods and services and 0.7% of current GDP scale for 2023.

Although the mobilization interest rate has increased slightly, the average lending interest rate will still be lower than the same period last year in the second half of 2024. Therefore, consumption and consumer credit can still benefit somewhat from this factor.

The analysts expect that Vinamilk and Masan Consumer will maintain their high market share they built in the first half of 2024 by continuing promotional policies at points of sale and leveraging the effectiveness of previous advertising and marketing campaigns. However, the overall improvement for the entire year of 2024 is forecasted to be only about 0.5-1% compared to the same period last year due to these companies already reaching market saturation domestically.

Market share of Vinamilk and Masan Consumer in key product categories. Source: VDSC

VDSC also noted that general consumption in the second half of 2024 will still face several bottlenecks, making high growth compared to the same period last year difficult. For instance, poor purchasing power in major markets (US, Europe) directly affecting industrial production of FDI enterprises, thereby creating fewer jobs and lower incomes for Vietnamese citizens; the real estate market remains stagnant.

“In conclusion, the domestic revenue growth of these major players is generally unlikely to reach a double-digit surge”, VDSC expressed.