ESG in practice: “Time is of the essence”

The requirements for Environmental, Social, and Governance (ESG) will become increasingly important as the stock market is upgraded. Listed companies need to focus on ESG issues to enhance the quality of corporate governance and meet international standards.

Legal Regulations

First, it is necessary to clarify the factors related to ESG. Regarding the environment (E), this includes climate change and carbon emissions, energy efficiency, environmental pollution, natural resource use, waste management, clean energy and technology, and biodiversity. For social (S) factors, this encompasses labor relations, workforce diversity, occupational safety and working conditions, human rights and child labor, product safety, community engagement, and supply chain management. As for governance (G), this involves the independence and diversity of the board of directors, compensation policies, business ethics, risk management and oversight, cybersecurity, legal compliance, anti-corruption, bribery and money laundering.

The legal regulations related to environmental factors include: Law on Environmental Protection 2020, Decree 06/2022/ND-CP on greenhouse gas emission reduction and ozone layer protection, Decree 08/2022/ND-CP detailing certain provisions of the Environmental Protection Law, Circular 01/2022/TT-BTNMT guiding the Law on Environmental Protection on climate change response, and Circular 02/2022/TT-BTNMT stipulating the implementation of a number of articles of the Law on Environmental Protection.

Regulations related to social factors include the 2019 Labor Code, the 2020 Enterprise Law, the 2010 Law on Consumer Protection, the 2005 Commercial Law, and the 2018 Law on Anti-Corruption.

Regulations on corporate governance include the 2020 Enterprise Law, the 2019 Securities Law, Decree 155/2020/ND-CP detailing a number of articles of the Securities Law, and Circular 96/2020/TT-BTC guiding information disclosure on the stock market.

Among these, regulations on ESG disclosure according to Circular 96/2020/TT-BTC (Appendices II and IV) require assessments of environmental impact, management of raw materials, energy consumption, water usage, compliance with environmental protection laws, policies related to employees, reports on responsibilities towards local communities, and reports on green capital market activities as guided by the State Securities Commission (SSC).

In particular, regulations on ESG information disclosure according to Circular 96/2020/TT-BTC (Appendix II, IV) require environmental impact assessment, management of raw materials, energy consumption, water consumption, compliance with environmental protection laws, policies related to employees, reports related to responsibility to local communities, reports related to green capital market activities according to the guidance of the State Securities Commission (SSC).

ESG Practice Results

The practice of ESG (Environmental, Social, and Governance) in the strategy for developing Vietnam’s stock market aims to enhance the quality of corporate governance among listed enterprises above the Southeast Asian average, applying good ESG practices at the Stock Exchanges and the Vietnam Securities Depository and Clearing Corporation (VSDC), aiming for sustainable development, striving to upgrade the stock market from a frontier market to an emerging market by 2025 according to the classification standards of international organizations.

The solutions for achieving the aforementioned goals include enhancing transparency and the quality of goods, improving the annual reports of public companies, and focusing on sustainable development by applying ESG standards in line with international practices. To enhance the operational efficiency of the stock market, it is essential to adopt international ESG standards at stock exchanges and the Vietnam Securities Depository and Clearing Corporation (VSDC), aiming for green and sustainable development in the securities sector.

In reality, the practice of ESG in Vietnam is still in its infancy, primarily involving large enterprises. Some enterprises apply ESG passively and perfunctorily. The quality of corporate governance is not uniform among enterprises. Listed companies need to improve many factors, including disclosing information in English (currently only 80 out of nearly 800 listed companies do so).

Meanwhile, ESG requirements will become more important when the stock market is upgraded. Upgrading the stock market will help listed companies attract more investment capital from international funds, increase stock liquidity and improve the image of businesses in the global market. Therefore, companies need to pay attention to ESG issues to improve the quality of corporate governance, meeting international standards.

In 2013, the SSC collaborated with IFC to launch the Guide to Sustainability Reporting, with the aim of raising awareness and building capacity for listed companies in disclosing information related to ESG activities.

In 2016, the SSC collaborated with IFC, HOSE, and HNX to issue the Guide to Environmental and Social Disclosure, helping companies understand information related to environmental and social activities.

In 2019, the SSC published the Corporate Governance Principles according to best practices for public companies, providing recommendations on best corporate governance practices according to the OECD.

In 2020, the Ministry of Finance issued Circular 96/2020/TT-BTC guiding information disclosure on the stock market, requiring public companies to disclose information related to the company’s environmental and social impacts.

In October 2024, the State Securities Commission, in collaboration with the UK Government’s Partnership for Climate Change (UK PACT), introduced the ESG Information Disclosure and Implementation Handbook to implement and improve the quality of ESG information disclosure for Vietnamese enterprises.

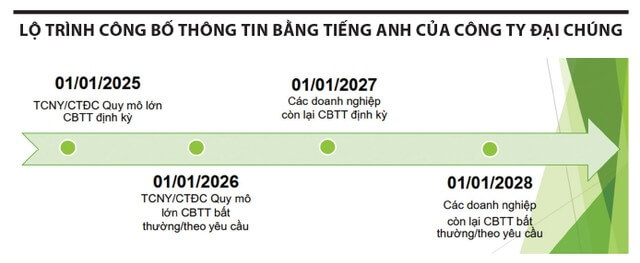

In October 2024, the Ministry of Finance issued Circular 68/2024/TT-BTC, effective from November 2, 2024, regulating the roadmap for public companies to disclose information in English (see figure).

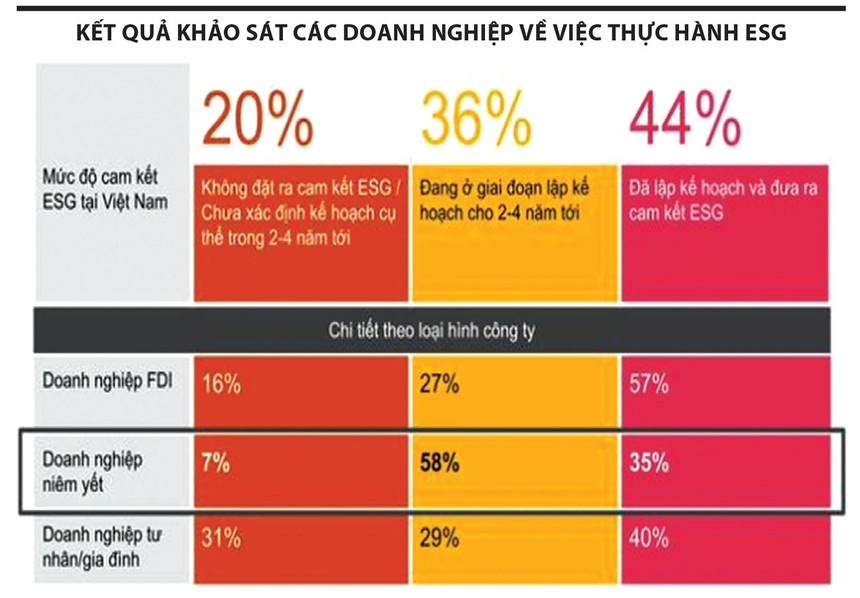

According to a survey by PwC and VIOD with 234 participants, 80% of Vietnamese enterprises are committed or intend to make ESG commitments in the next 2-4 years (see table).

The management agency has issued many policies and regulations to encourage enterprises to practice ESG. International organizations such as the World Bank and ADB support Vietnam in the process of capacity building and implementing ESG projects.

According to statistics from the 2024 Sustainability Reporting Awards, the number of separate sustainability reports increased from 12 in 2020 to 14 in 2021, 18 in 2022, 21 in 2023 and 33 in 2024.

Positive points that can be seen include widely applied international standards (GRI, SASB, SDG). The number of enterprises setting targets for ESG indicators has increased. The number of participating organizations has also increased and there are many new faces from the banking and financial companies.

However, not many businesses have disclosed their environmental and social impacts through policies and practices with stakeholders, and have published and practiced codes of ethics.

The number of businesses disclosing information in English is still limited. Some businesses have not ensured the structure and number of independent board members according to regulations. The structure and composition of business leaders are not gender balanced, and the number of businesses with independent board chairmen is very modest.

Key Points to Note

First, enterprises need to change their awareness and thinking in production and business activities, in addition to the profit factor, they also need to add ESG practice factors in their long-term business development strategy.

Second, strengthen research and study of international standards related to ESG practices in enterprises to improve the quality of information disclosure associated with ESG factors.

Third, comply with regulations on information disclosure and corporate governance according to current securities laws, strive to disclose information beyond compliance, and effectively use the Code of Conduct.

Fourth, conduct corporate governance according to best practices. Comply with the regulations on preparing corporate reports in English according to the roadmap of Circular 68/2024/TT-BTC, creating conditions for foreign investors to access information in a transparent and convenient manner, increasing opportunities to attract foreign investment capital for enterprises.