Vietnamese consumers are currently focused on managing their spending effectively and economically, with top priorities on product quality and essential goods. However, they prefer choosing products that are sustainable and practical…

Product quality and usability are top priorities for consumers. Illustration image.

According to the latest report by NielsenIQ (NIQ), consumer sentiment about the economic situation has gradually improved, with 45% agreeing with the statement “Vietnam is not in an economic recession at this time”. Accordingly, consumers’ financial situations are changing positively, and a large majority feel optimistic about their spending capabilities.

CONSUMERS REMAIN CAUTIOUS

The report on new trends that could drive growth in the retail market by 2025 from NIQ indicates that personal financial situations in Vietnam are expected to improve significantly in 2024, although essential cost burdens still persist.

Specifically, 67% of people said that their financial situation is better than the previous year, while only 10% said that their financial situation is worse. However, basic expenses such as healthcare (50%), food and goods (49%), as well as fuel (44%) are still a big burden for consumers.

Ms. Thao Huynh, Vietnam Industry Insights Lead, NIQ Vietnam, said that despite the improvement in the financial situation, consumers still maintain cautious spending and saving habits.

Faced with rising prices, consumers are also cautious in their shopping. Of these, 64% said they would only buy essential items when food prices increase and 63% would reduce their purchases. At the same time, they pay close attention to deals and promotions, with 75% always taking advantage of discount programs to save costs.

“However, the influence of promotions on brand and store selection is still limited, as 42% of consumers said they only buy products when they have a good impression of the brand,” Ms. Thao added.

In addition, Vietnamese consumers are becoming more savvy and conscious in their shopping habits. Accordingly, 85% compare prices before making a purchase, 80% prioritize products that have been chosen by many other consumers and 78% are willing to spend more on high-quality products. “This indicates that product quality is a top priority in purchasing decisions”, Ms. Thao emphasized.

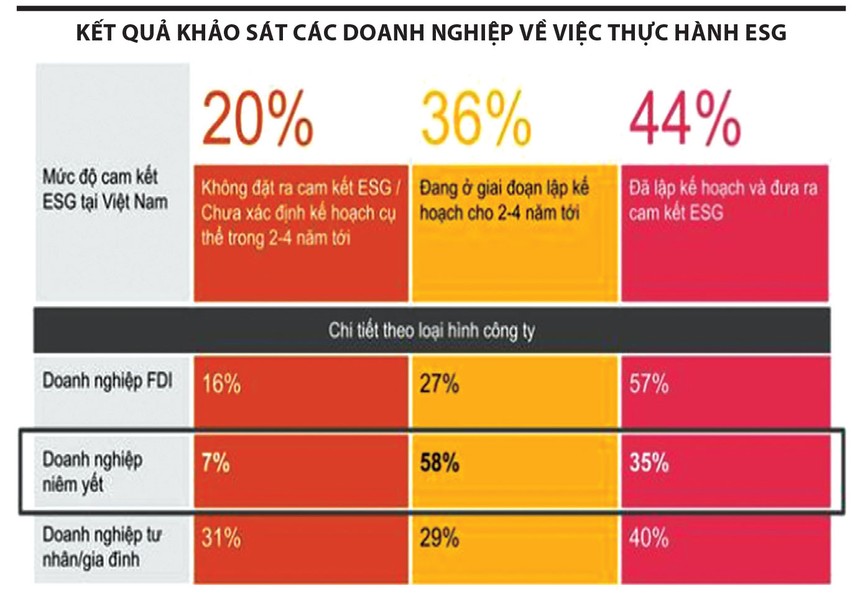

On the other hand, according to a survey by PwC, Vietnamese consumers are increasingly prioritizing sustainability in their consumption habits, with 94% reporting negative impacts of climate change in their daily lives (compared to 88% in the region).

Notably, 74% of Vietnamese consumers expressed their willingness to pay 20% more than the average price for a product made from recycled/sustainable materials, and up to 85% would consider buying a hybrid or electric vehicle in the next 3 years.

Vietnamese consumers are quite open to using artificial intelligence (AI) in low-risk activities, but still prefer direct human interaction for complex transactions. Specifically, 69% believe AI can assist with product information gathering, followed by making product recommendations (63%) and customer service support (59%).

F&B INDUSTRY PROMOTES DIGITAL TRANSFORMATION AND SUSTAINABLE DEVELOPMENT

According to a report from the Ipos Report management system, Vietnam’s F&B industry has achieved a growth rate of 10 – 12% in 2024 compared to 2023. With the 3rd highest revenue in Southeast Asia, Vietnam is currently one of the most potential markets in the region in this field.

F&B quickly responded positively to anticipate recovery in 2024 – Illustration image.

On the other hand, according to transaction data via the Payoo payment platform, the economy shows many positive signals, with consumer purchasing power rising significantly in the first half of 2024, presenting an opportunity for many industries to recover.

In particular, the food and beverage industry – F&B (Food & Beverage) quickly responded positively to anticipated the recovery in 2024. A recent survey of 3,000 F&B businesses by Payoo revealed that about 80% of businesses in Vietnam remain optimistic and have the resources to grow in 2024, with nearly 52% having expansion plans.

Forecasts indicate that this year, the value of the food and beverage market in Vietnam is expected to increase by 10.92% compared to 2023.

Last year, Payoo also focused on the F&B segment and expanded its customer base within this group, recording a high increase in spending. Specifically, the number and value of F&B transactions through the system increased by 38% and 54% respectively. Payment by international cards still dominates but slightly decreased to 65% of transaction volume, followed by QR code payments at 30% and domestic cards at 5%.

In addition to traditional payment solutions at POS counters, Payoo has also introduced a prepayment solution that allows customers to purchase packages in advance and store them within the apps of several major brands for future use.

Responding to the tastes of consumers, especially the younger generation and the consumption trend towards sustainable development goals, many businesses in the F&B industry have improved business processes, applied technology, and digitally transformed their approach to customers.

For example, the Vinamilk brand has invested in technology and green solutions at its farms and factories. Vinamilk stores are gradually transitioning to using recycled plastic bags, contributing to reducing plastic waste.

Similarly, Acecook Vietnam has also replaced plastic packaging for cup noodle products such as Modern and Handy Hao Hao with paper packaging, along with switching to using forks made from bioplastics derived from certified bio-based materials.

Recently, Saigon Beer – Alcohol – Beverage Corporation (SABECO) officially opened the SABECO Beer Research and Development Center (SRC). SABECO representative said that the launch of SRC will create a beer research and development system at an in-depth level to innovate technology, research and apply new materials, new processes to improve and produce, suitable for Vietnamese culinary culture and tastes.

Or recently, Pernod Ricard has also launched an electronic label E-label that can be accessed via QR codes printed on the back labels of Pernod Ricard products. By scanning the QR code with any mobile device, consumers in Vietnam will be directed to a dedicated platform providing detailed information about the beverage product, health risks related to misuse, and guidelines for responsible drinking.